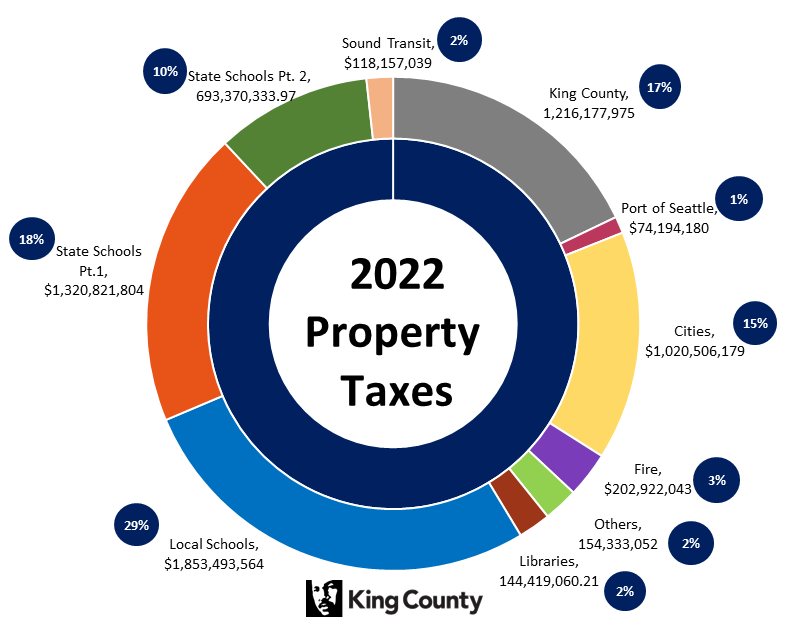

About 57 percent of property tax revenues collected in King County in 2022 pay for schools. Property taxes fund voter-approved measures for veterans and seniors, fire protection, and parks. King County receives about 17 percent of your property tax payment for roads, police, criminal justice, public health, elections, and parks, among other services.

Seniors and the disabled must be aware of our state’s property tax relief programs. King County taxpayers who are 61 years or older, or disabled, own their home, and have an annual income of $58,423 or less after certain medical or long-term care expenses, may be eligible for tax relief.

Taxpayers should visit the King County website for more information and apply online as required.